Create Your Legacy

Outright Gifts

When you are able to make charitable gifts during your lifetime, you get to see the gift’s impact on Alliance Française! Making an outright gift also offers the greatest tax benefits to the donor, and there are several ways to transfer assets to our non-profit for the biggest impact.

Alliance Francaise de Mpls-St Paul

EIN 51-0178191

Retirement Assets

Donation of retirement assets is often the best use for a charitable gift. Tax-deferred accounts (IRA, 401K, 403B) come due for a Required Minimum Distribution at age 73, and are typically counted as income by the IRS. By gifting your distribution to charity, the distribution passes free of income tax or capital gains tax, reducing your taxable income and allowing AFMSP to receive the full value of the donation.

Some donors choose to donate Appreciated Assets to charity, which not only avoids capital gains tax that would be due at sale, but avoids adding the gain to taxable income and triggering other taxes.

Donor Advised Funds are another increasingly popular resource for charitable giving, and can be easily established with most major investment firms (Fidelity, Schwab, etc) or through a local foundation such as the St Paul & Minnesota Foundation or the Minneapolis Foundation. These funds give you the means to support causes important to you now, and leave a gift for the future when you designate AFMSP as a beneficiary.

Did you know?

Qualified Charitable Distributions can begin earlier — at 70 1/2 years old — allowing you to avoid income taxes on charitable distributions while supporting the organizations you choose, up to $108,000 annually!

Planned Giving

Beneficiary Designations

Adding AFMSP as a beneficiary designation is the simplest and most straightforward way of ensuring your donation bypasses probate and goes straight to the organization. AFMSP can be named as a primary or contingent beneficiary on:

Donor advised funds

Retirement accounts: IRAs, 401(k)s, 403(b)s, etc. (Unlike your heirs, AFMSP isn’t required to pay income taxes on the amount received.)

Securities: stocks, bonds, and mutual funds

Bank accounts: savings, checking, money market, and certificates of deposit

Insurance policies: either as a beneficiary or owner

Bequest in Will or Trust

Making a bequest via a will or living trust is a simple way to leave a personal legacy that supports AFMSP. Donor states the amount to the AFMSP as a percentage, a specific amount, or the residue (remainder) of the estate. See the flyer above for suggested wording of this gift to the organization.

Charitable Gift Annuity

Establishing a Charitable Gift Annuity or a Charitable Remainder Trust allows you to make a gift to a non-profit while receiving a fixed income stream during your lifetime. Plus donors qualify for an immediate tax deduction. This can be an excellent option to consider if you have highly appreciated assets, stock, or required minimum distributions from an IRA. Donors can also use cash to create these gifts. These products can be established with most major investment firms, or you can consult with a local foundation such as St Paul & Minnesota Foundation to benefit from advisors with a more specialized knowledge of the non-profit landscape in the region.

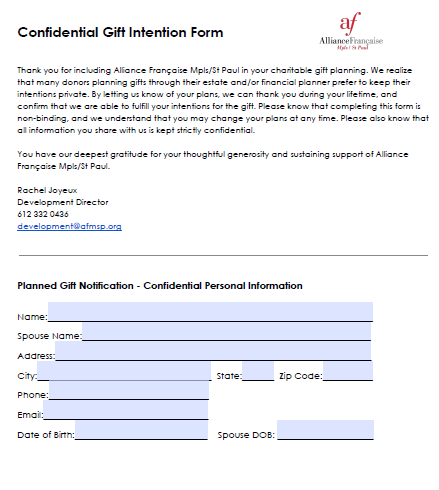

We would be happy to meet with you as you consider ways to leave a legacy at the Alliance Francaise Mpls/St Paul. Please reach out to Rachel Joyeux, Development Director or Christina Selander Bouzouina, Executive Director, to discuss the most meaningful ways you envision leaving a legacy for the AFMSP community.

Alliance Francaise de Mpls-St Paul

EIN 51-0178191